12 startup marketplaces you can trust | Acquire to Flippa

Bootstrapped and ready to sell your online business? Or looking to acquire and grow? Here's the best startup marketplaces to do so.

Surges is 100% independent, but some links may earn us an affiliate commission. Learn more.

Thinking about an exit? Fortunately, selling online businesses is easier than ever with an army of marketplaces and brokers able to assist you. With a queue of potential buyers on their database, there really is no need to go it alone.

It’s the same story for potential acquisitions, as listings have never been so buoyant in volume and potential. A dream scenario for website flipping.

That said, online marketplaces come in all shapes and sizes, with different sales processes, so it’s worth knowing the benefits of each, which are open to potential offers, what support they come with and the fees involved for all parties.

The best places to buy and sell online businesses are:

- Flippa

- Empire Flippers

- Motion Invest

- Acquire

- GetAcquired

- Exchange Marketplace

- SideProjectors

- Investors Club

- Blogsforsale.co

- Latona’s

- BitsForDigits

- Tiny Acquisitions

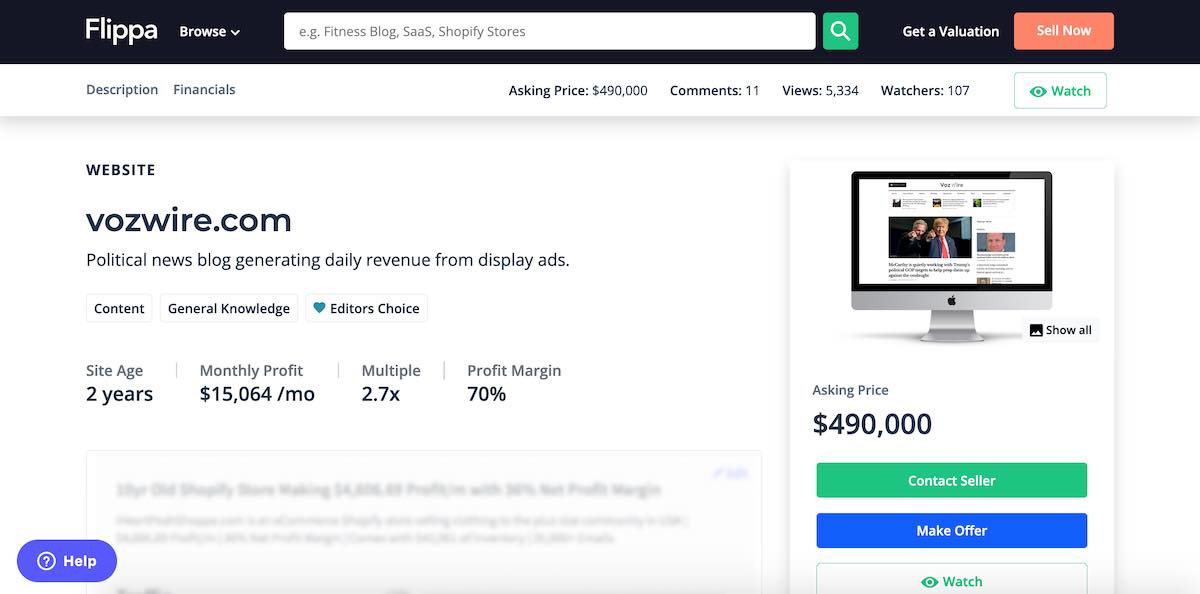

Flippa - 250,000 interested startup buyers

Flippa is the #1 global marketplace for digital assets. Be that SaaS companies, apps, newsletters, blogs or domain names. It sells a huge number of each at any one time and has facilitated over 40,000 assets sold since 2009 with huge network effects on its side.

Using Flippa, you can list your online business for sale with key metrics and a product demo; find and communicate with qualified potential buyers; agree terms; perform due diligence and get paid. As part of the listing process, Flippa will even give you an expert valuation based on your historical performance and asset type. A streamlined end-to-end startup sales process!

For the pleasure, Flippa charges a small listing fee (starting at $39) and a ‘success fee’ (a 5-15% of the total transaction). Of course, there’s the evitable upgrades to make their newsletter, run confidential listings or receive assisted listing support. With 250,000 buyers on their books, Flippa has the right level of visibility and safeguards in place to push up your startup’s asking price.

The Flippa marketplace is so popular it’s even spawned a new way to make money online: website flipping!

Microaquire Vs Flippa - which is best for what?

I have personally purchased over $15,000 worth of small businesses on Flippa and I pay the $390 annual fee to be a member of the Acquire buyers pool.

Flippa shines as the ultimate startup marketplace platform where you can buy startups, sell them, and showcase content sites and brands - even those valued under $50,000. Its user-friendly interface and vibrant community make it a prime choice for sellers and buyers alike. While Flippa takes the lead in this domain, Acquire stands as a commendable second option for those interested in purchasing and listing high-quality SAAS products. For a more in-depth comparative anaylsis of Flippa vs Microacquire (Acquire), highlighting why Flippa is placed at the top among Microacquire competitors, check out our review here: Flippa vs Acquire.

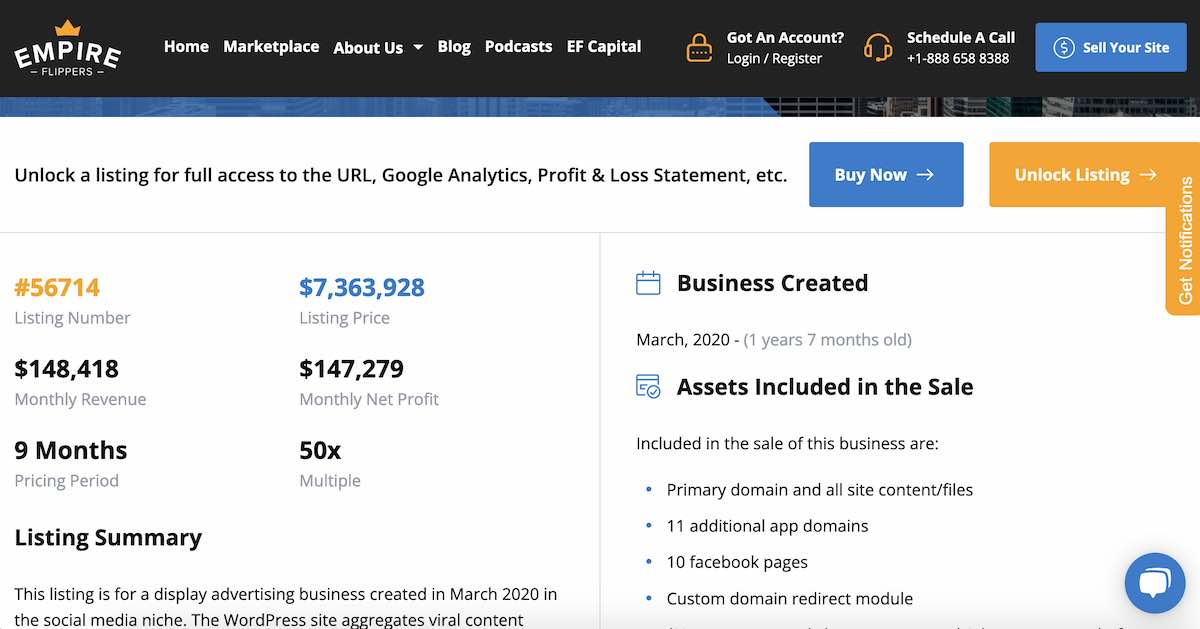

Empire Flippers - established sites for sale only!

The first online business Empire Flippers sold was their own . Fast-forward to today and Empire Flippers has done over $200m in successful deals covering Amazon sellers, eCommerce stores, SaaS, subscriptions, portfolio companies and affiliates. Empire Flippers lists new digital businesses for sale every Monday so keep your eyes peeled.

Sales under $700,000 are charged a flat rate of 15% commission on the final price. For that, you get: verified listings; promotion to a big pool of serious buyers; a success rate of 82%; and concierge migration service once a deal is done. Customer service is noticeably superior every step of the way. They’ve many years in the game so can get under the skin of complex deals with a cap table, deal structuring and Intellectual Property law.

Empire Flippers only works with established sites – whether that’s stable income streams, solid traffic or real followers. As a result, you can expect a higher selling price than with online marketplaces with less due diligence. The price for all this is a fixed $297 listing fee.

And if you’re wondering what to do after you sell, Empire Flippers is always on the lookout for proven operators to grow a portfolio of sites. EF Capital is their fund pairing accredited investors with builders of content or SaaS websites. You get to choose the niche, the sites, how you grow it and the level of profit you re-invest. The fund aims for 20% average annual returns for all parties.

Empire Flippers is a one stop shop for buying and selling startups and more established online businesses.

Motion Invest - for a quick startup sale

Motion Invest’s startup acquisition deals are typically $20,000 or less. All sites are vetted by seasoned and passionate flippers, and are either put up for sale by the third-party owner or Motion Invest themselves. As a seller you get a guaranteed sale, with Motion Invest a happy buyer if you’re looking for a quick deal.

Listings must be profitable, be it through Affiliate. Adsense, display ads, Ezoic or sales, typically in the $500-$5,000 per month range. In other words, proven but ripe for growth. Sale prices are fair and key metrics extremely transparent.

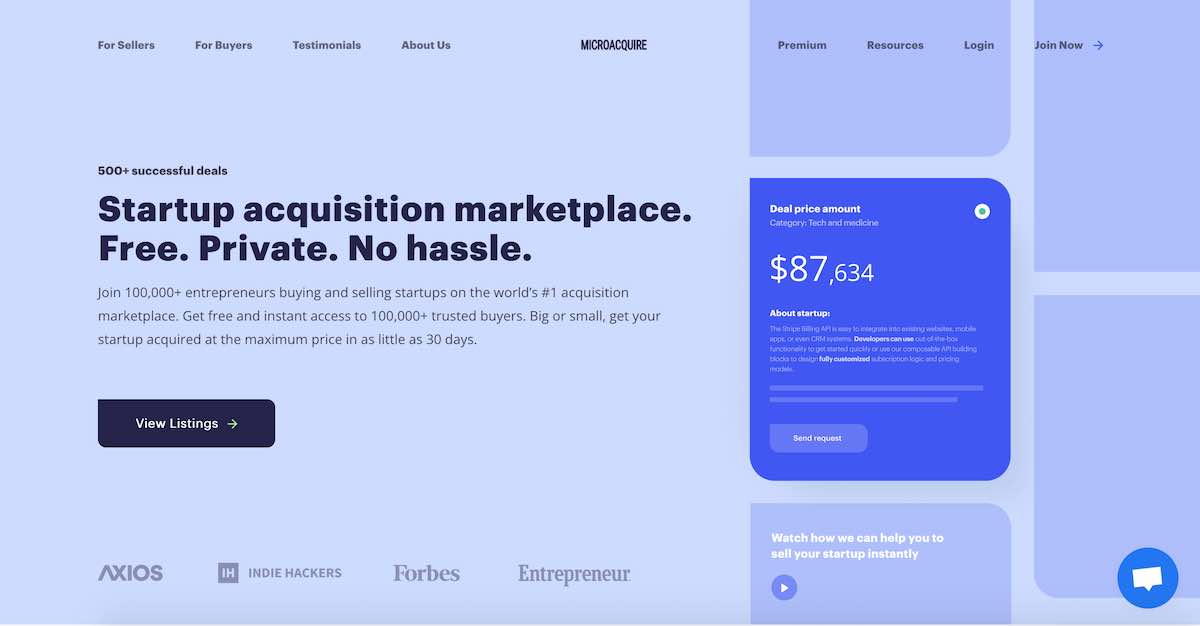

Acquire (rebranded from MicroAcquire) - the bootstrapper’s marketplace

Ditch the brokers and go direct with this fuss-free startup marketplace. As the name suggests, Acquire deals in early stage startups rather than behemoths, specifically companies with $500,000 ARR or less. Typical business models are SaaS, ecommerce, affiliates and display ads.

Founder Andrew Gazdecki recognises that selling your business is usually a long and painful experience. Full of shady tactics and dead ends. Acquire does the background checks upfront and cuts through the crap so you can get deals done in 30 days or less – with zero fees or commission! Because they’re happy to do all the heavy lifting, it’s fast becoming a popular service with first-time sellers.

As Andrew told us: “Our mission is to bring the startup acquisition market together, with trust, transparency and ease of use. Were going to help millions of founders get MicroAcquire’d and experience an outcome that changes their lives.” - Andrew Gazdecki, CEO of Acquire

As of August 2023, Acquire has done:

- 500+ successful acquisitions

- 1000,000+ registered buyers

- 2000+ active startup listings

- $200+ million in closed acquisitions

…not bad considering it only got started in 2020!

The typical Acquier buyer is somebody looking to skip the work involved in getting something started and instead take an existing website or SaaS business to the next level. Plus, you can now raise funds from investors for startup acquisitions within Acquire itself. Game changer!

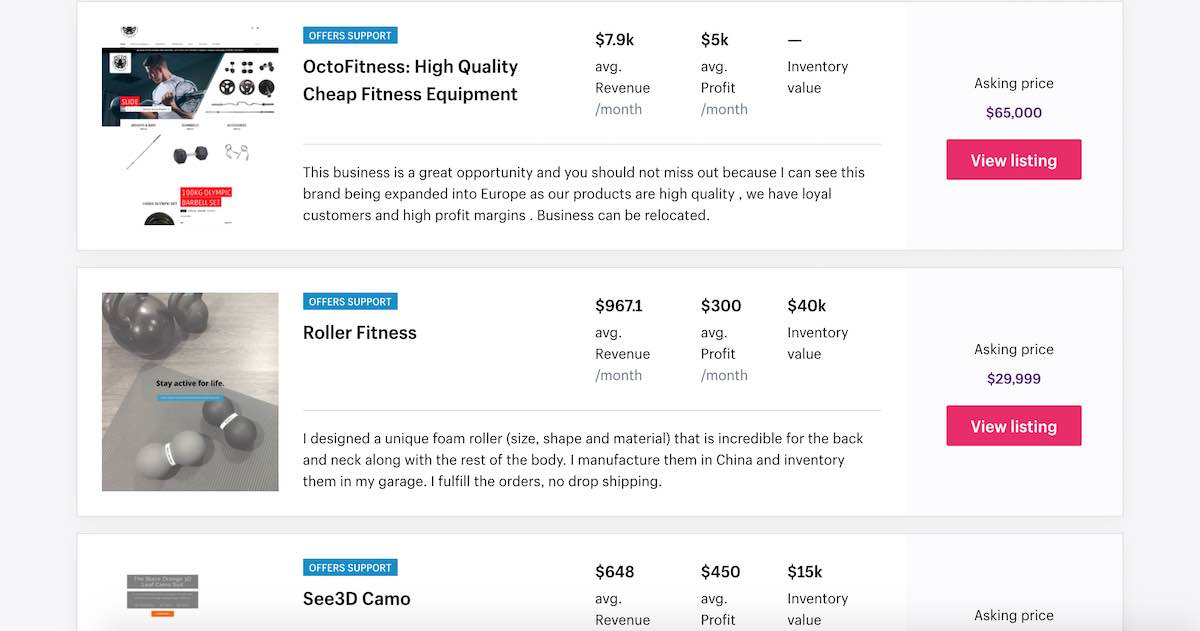

Exchange Marketplace - by Shopify, for Shopify stores

Powered by Shopify, Exchange Marketplace is the number one place to buy and sell Shopify stores. Being owned by Shopify, both parties can proceed with confidence. Sales and traffic data on listings is locked-in by Shopify’s dashboards, payment is secure and there’s even migration support once you’ve made your purchase.

Like Flippa, there’s a store valuation tool to help put a realistic price tag on your business.

Interested buyers will love the curated lists of stores for sale that allow you to find a bargain, be it a dropship store, local business or a Shopify Partner App for sale. There’s so much choice and the multiples are very reasonable.

UPDATE: After November 1, 2022, Shopify is “recommending merchants use other marketplaces for buying or selling their commerce brands.”

GetAcquired - the specialist SaaS marketplace

Another new kid on the block, looking to speed and shake up the traditional buying process. GetAcquired deals exclusively in buying and selling SaaS startups.

Listings are hidden from public view, but once you’re registered you’ll get access to a wealth of SaaS businesses for sale, complete with verified listings thanks for billing and analytics integrations, such as Stripe, Recurly, Google Analytics and App Store.

GetAcquired like to nudge sales along so they’ll facilitate introductions, offer advice on all aspects of a deal and can even join your team and strike the best possible price for sellers for an additional fee.

Pricing is not obvious until you get closer to listing and you can tell the service is just getting started. Not the biggest or the most complete but definitely one to watch.

SideProjectors - the DIY option

Born out of a hackathon in 2013, SideProjectors is a growing community of hackers and makers working on side-projects. Their online marketplace for selling and buying side-hustles is 100% free to use – there’s no listing fee and no cut on any deal.

The first step is to integrate your ProductHunt page to retrieve your project and pre-fill the submission form. With no diligence process, this is probably the quickest site on which to list your startup.

If your side-project simply needs more manpower, you can also use SideProjectors to advertise for a co-founder or a collaborator.

Investors Club - added investment advisory services

For deals in the $20,000-$100,000+ range. Investors Club undertake rigorous due diligence for its members, who pay an upfront premium for the privilege of detailed reports and early-access to deals – a £247 p/a or $747 lifetime membership fee. In exchange for no fees on the seller side, they must sign an exclusivity agreement guaranteeing they won’t list it anywhere else.

Has a good feel about it for prospective buyers and sellers who want frictionless trades in high-quality sites. Investors Club’s 24-point buyer reports are a real win, covering areas such as traffic, SEO, niche analysis, competitive advantage, market share, growth-plans and domain health.

Blogsforsale.co - quality blogs for sale

I first heard about BlogsForSale.co and its sister site NicheInvestor.com on the Niche Pursuits podcast.

Chelsea Clarke, the brains behind both, is uniquely placed to help both parties in buying and selling websites. Both blog owners looking to grow their passion and investors wanting to acquire promising and profitable online businesses.

The small number of blogs listed on the online marketplace are curated and vouched for by Chelsea herself and come with unique content, verified monetisation and Google Analytics stats. No cookie cutter content here, although some are very early stages.

Chelsea has tools and guides advising on every area of growing a site through to sale, from starting a blog, to traffic and list growth, affiliate marketing, valuation, legal checks, the works. Blogsforsale.co has facilitated $1m in deals, ranging from $500 to six figures. A good deal is normally to be had.

Latona’s – lovingly managed marketplace

Named after one of its co-founders, Rick Latona, this website marketplace has grown from Harvard Business School project to big-time broker.

Latona’s don’t get out of bed for anything less than six figures and regularly do $1m-$5m+ deals. Covering business models from content sites, eCommerce membership, lead gen and SAAS. Domain portfolios too. Despite the range, there’s not a huge number of sites listed – 64 at the time of writing. Quality over quantity, with decent revenue streams.

They’ve got the usual tools to estimate your site’s value, added value professional services and a decent behind-the-scenes podcast.

BitsForDigits – sell a bit of your website

A very unique take on buying and selling a website. BitsForDigits deal exclusively in partial buyouts, connecting founders of profitable online ventures and cash-rich investors looking for a nest egg.

Listings are anonymous, plus you get to decide how much of the business to part with (1-99%) and to whom. Your new co-owners are fully vetted but BitsForDigits don’t get involved in the legal nor financial matters of a sale. Their main role is matchmaker, for which they don’t yet charge any fees or commission.

As BitsForDigits told us in our exclusive interview: “Partial buyouts are a better option for founders who do not necessarily need money to grow the company but want to take some chips off the table and get experience liquidity (for example to buy a new car or an apartment). They are also a great alternative to full acquisitions in which founders have to sell their entire business.” - Jan-Philipp Peters, BitsForDigits co-founder

Tiny Acquisitions - buy small websites < $10,000

Size isn’t everything. Tiny Acquisitions is a charming online platform for picking up projects up to $10,000. Aimed at eager entrepreneurs wanting to take a fledging yet proven idea to the next level.

The entire end-to-end process is done in-app from offers and dialogue to invoicing and online payments via Stripe. It’s free to explore small businesses listings, however, interested buyers must pay $199 for Premium membership in order to see detailed metrics and advance to a sale. If you’re really in a hurry, a big bonus is being able to make an instant purchase!

Tiny Acquisitions isn’t as polished as the other marketplace companies quite yet but is still a promising place to sell projects online.

Dan.com (bonus) - buy and sell unused domains

If, you me, you’re sitting on a graveyard of domain names deserving of a better owner, I thoroughly recommend listing them on Dan.com.

The no-nonsense online marketplace makes it easy to list a domain for sale or hire. Simply point its very own For Sale page, set your price and wait for the first offer to come in. Renting your domain out or letting the prospective buyer pay in installments is another option, although both options come with higher fees.

Dan.com has brokered over 100,000 domains and I can vouch for how quick and easy the process is from initial offer to transfer. Payouts usually take 12-24 hours.

In summary

The marketplace industry is taking off. Unlike a few years ago, you’re spoilt for choice when it comes to buying and selling businesses online. It needn’t be a time consuming or painful affair.

As a potential buyer, it’s important to do your research, investigate the niche and the added value you’re getting with any sale. Verified revenue and other key metrics are a must. Check out recent ratings on software review sites and try a few valuation calculators to ensure the asking price is fair. Don’t forget the upsides too - make sure you know the easy wins you’ll put in place to grow the site (e.g. startup directory backlinks and top content marketing tools) and consider what your own exit might look like.

Most of all, good luck!

Additional resource: → Course Review: Become a Website Flipping Pro